The IRS Militarization and Weaponization is Becoming a Very Real Issue and You’ll See How Bad it Really is in This Investigation

Introduction

Recent revelations about the Internal Revenue Service (IRS) have raised eyebrows and sparked concerns regarding its growing arsenal and expanding workforce. A watchdog organization called Open the Books has shed light on the IRS’s significant expenditures on weaponry and military-style equipment over the past couple of years. With over $10 million spent in just four months, the IRS’s militarization prompts questions about its role and potential consequences. In this article, we explore the startling details that have emerged, inviting readers to ponder whether the IRS has transformed into a small military unit.

Weaponry and Gear Accumulation

According to the Open the Books report, the IRS has allocated a staggering $35.2 million on firearms, ammunition, and military equipment since 2006. The peak years of expenditure were observed in 2020 and 2021, coinciding with the onset of the COVID-19 pandemic. During this period alone, the IRS spent $10 million on weaponry and gear.

While the IRS is primarily known for its tax collection role, it is important to note that it employs nearly 2,100 special agents. IRS Chief testimony revealed plans to add 600 new positions and hire 20,000 new individuals overall. With this expansion, the IRS’s special agent-to-headcount ratio places it among the top 50 largest police departments in the country, alongside 12,261 law enforcement agencies.

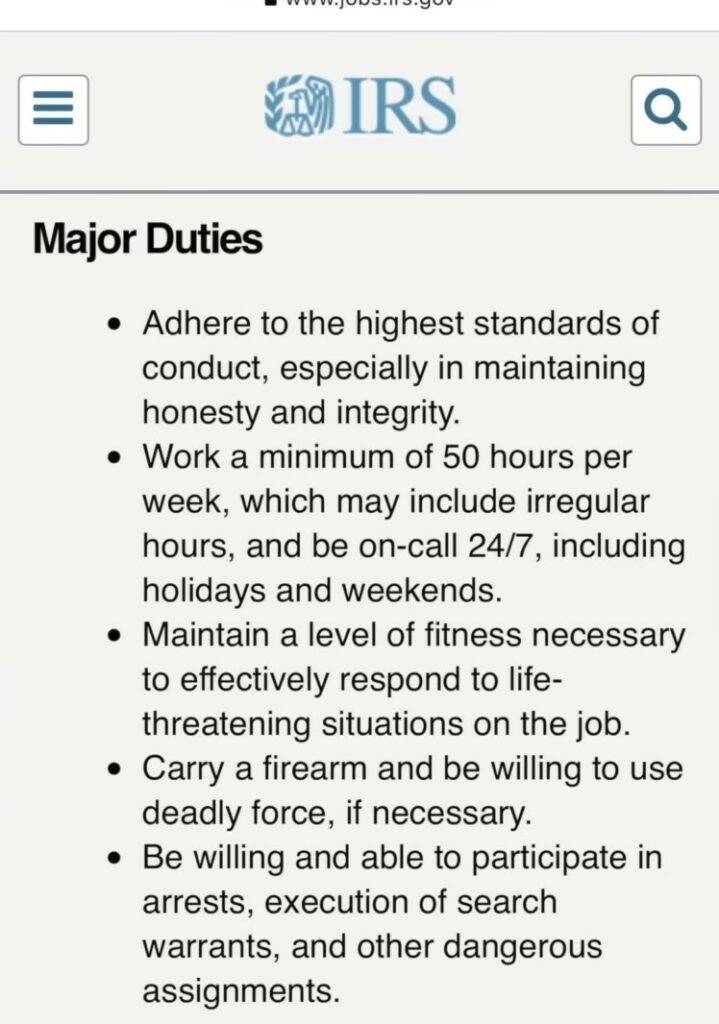

Controversial Job Posting

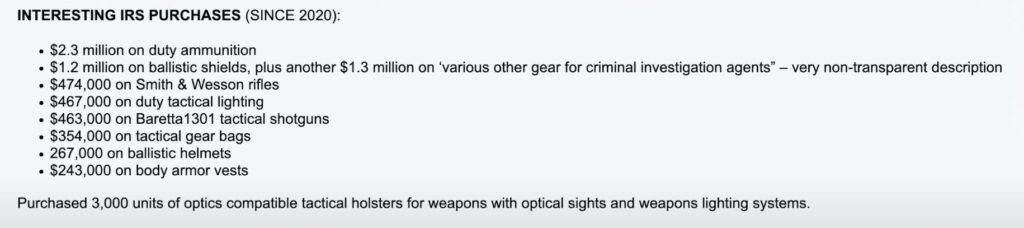

Adding to concerns about the IRS’s growing militarization was a job posting that surfaced in August 2022. The posting outlined requirements for potential IRS recruits, including the willingness to work a minimum of 50 hours per week, maintain a high level of physical fitness, carry firearms, and be prepared to use deadly force. The language in the job posting raised eyebrows, leading to its prompt removal. However, the IRS’s intentions had already been exposed.

The IRS’s Arsenal

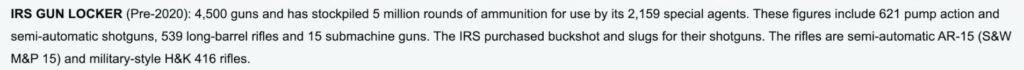

Prior to 2020, the IRS possessed an impressive armory, including 4,500 firearms and stockpiles of 5 million rounds of ammunition for its 2,159 special agents. The inventory featured various weapons, including pump-action and semi-automatic shotguns, long barrel rifles, and submachine guns. Notably, the rifles included semi-automatic AR-15s and military-style H&K 416 rifles.

Since 2020, the IRS has further enhanced its arsenal. The expenditures include $2.3 million on duty ammunition, $1.2 million on ballistic shields, and $1.3 million on undisclosed gear for criminal investigation agents. Additionally, significant sums were allocated for specific items such as Smith & Wesson AR-15s, duty tactical lighting, Beretta 1301 tactical shotguns, tactical gear bags, ballistic helmets, and body armor vests.

Implications and Concerns of the IRS Militarization

The combination of the IRS’s growing firepower and increased recruitment has raised concerns about the potential weaponization of the agency. The allocation of over $80 billion in new funding and plans to hire nearly 87,000 new agents over the next decade has amplified these concerns. Critics argue that such developments could enable the IRS to be used as a tool to target individuals based on political affiliations, as it has done in the past.

Conclusion

The recent revelations about the IRS’s substantial expenditures on weaponry and gear, coupled with its expanding workforce, have ignited debates about the agency’s evolving nature. While the IRS’s primary purpose is to collect taxes, its transformation into what appears to be a small military unit has left many perplexed.

The implications of an armed tax collection agency and the potential consequences of its increased powers raise important questions about government overreach and the role of the IRS in society. As discussions continue, it is crucial to carefully examine the necessity and proportionality of the IRS’s militarization, ensuring that its actions align with its intended purpose of tax administration.

Transparency and accountability are essential in maintaining public trust in government agencies. The IRS should provide clear justifications for its weapon acquisitions, gear expenditures, and workforce expansion, addressing concerns about the potential misuse or overstepping of authority. Additionally, robust oversight mechanisms should be in place to ensure that the IRS operates within the boundaries of its mandate and respects individual rights and liberties.

Ultimately, striking a balance between equipping the IRS with necessary resources for its law enforcement functions (if it even needs them) and safeguarding against the potential abuse of power is a delicate task. The ongoing discussion surrounding the IRS’s role as a tax collection agency and its transformation into what resembles a small military unit serves as a reminder of the importance of maintaining a vigilant and informed citizenry to ensure accountability and protect individual liberties.

This IRS militarization and weaponization is all just further reason why the IRS should be abolished. What are your thoughts of the IRS militarization and weaponization?