The Gold Standard: Past, Present, and Future

The gold standard was first established in the United States in 1792 when the U.S. Congress passed the Coinage Act. Under this act, the U.S. dollar was defined as a fixed weight of gold, and any holder of a U.S. dollar could exchange it for a fixed amount of gold. This gave the dollar stability and made it a reliable store of value.

For much of the 19th century and the first half of the 20th century, the U.S. dollar remained on the gold standard. However, the U.S. government began to move away from the gold standard during World War I. To finance the war effort, the U.S. government began to issue large amounts of paper currency that was not backed by gold.

After the war, the U.S. dollar was still redeemable in gold, but the government continued to print paper currency, which led to inflation. In 1933, President Franklin D. Roosevelt issued an executive order that prohibited the private ownership of gold, effectively ending the gold standard. The government required all citizens to turn in their gold to the Federal Reserve in exchange for paper currency, and the U.S. dollar was no longer redeemable in gold.

In 1944, the United States played a leading role in the Bretton Woods Conference, which established a new international monetary system. Under this system, the U.S. dollar became the world’s reserve currency, and other countries agreed to fix the value of their currencies to the U.S. dollar. The U.S. government agreed to redeem U.S. dollars for gold at a fixed rate of $35 per ounce, and other countries could exchange their U.S. dollars for gold as well.

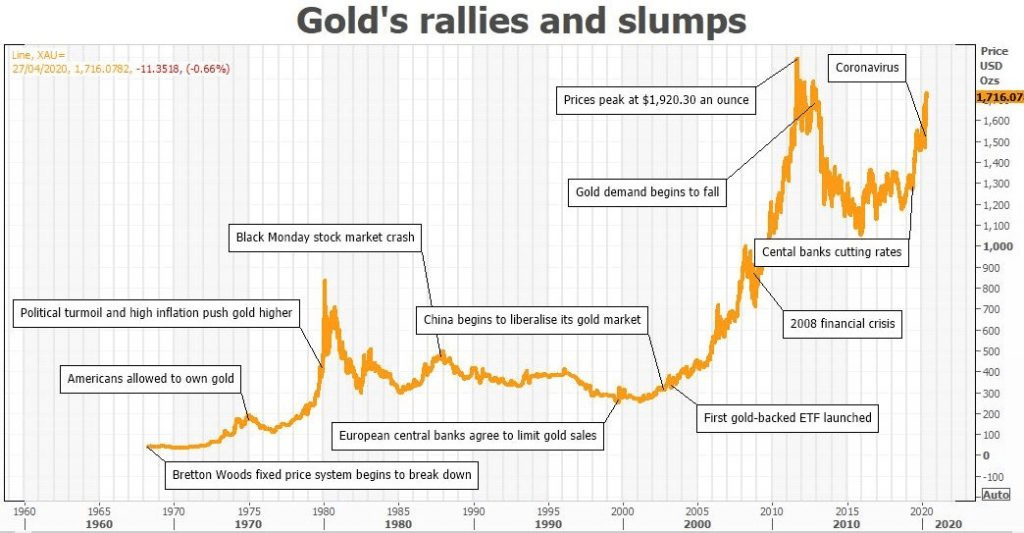

For much of the post-war period, the Bretton Woods system worked well, and the U.S. dollar remained a reliable store of value. However, by the 1960s, the U.S. government was facing a significant fiscal crisis. The cost of the Vietnam War and the Great Society programs led to a significant increase in government spending, which, in turn, led to a significant increase in the supply of dollars. At the same time, the U.S. balance of payments was deteriorating, and the country was facing a trade deficit.

To finance these deficits, the U.S. government had to print more dollars, which led to inflation. By the early 1970s, inflation had reached double digits, and the value of the dollar was rapidly declining. In 1971, President Richard Nixon made the decision to suspend the convertibility of the U.S. dollar into gold, effectively ending the gold standard.

This decision had several immediate effects. First, it led to a significant devaluation of the dollar, as other countries realized that the U.S. government was no longer willing or able to back its currency with gold. Second, it led to an increase in inflation, as the government was free to print as much money as it needed to finance its deficits. Finally, it created a situation where the U.S. dollar was no longer a reliable store of value, which meant that people had to find other ways to protect their wealth.

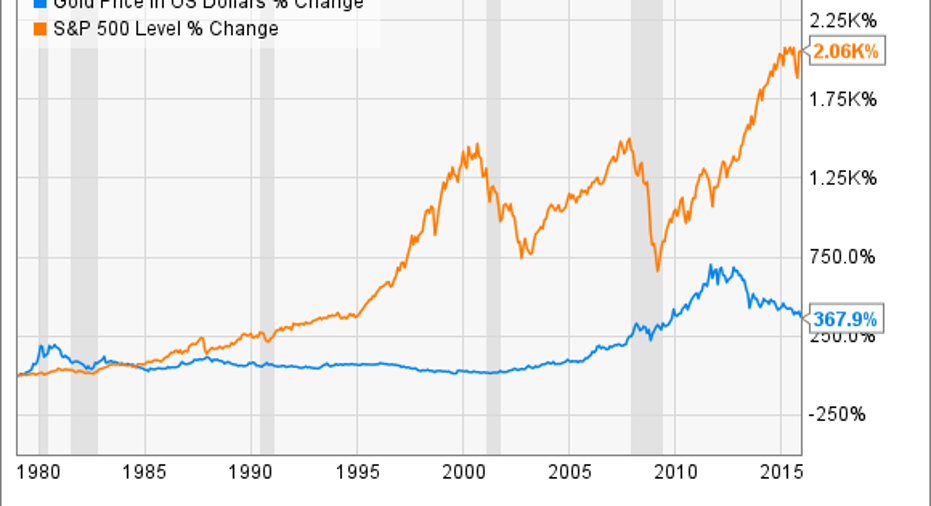

Since the switch to fiat currency, inflation has remained a persistent problem in the United States. In the 1970s, inflation reached double digits, and it has remained above the Federal Reserve’s target of 2% for much of the past decade. The size and power of the federal government have also continued to grow, as the government has been able to spend more than it takes in without facing any immediate consequences.

Returning to the gold standard would help to address these problems. By tying the U.S. dollar to gold, the government would be limited in its ability to print money, which would help to prevent inflation. Under the gold standard, the government would only be able to issue new currency if it had a corresponding amount of gold reserves to back it up.

Additionally, the gold standard would help to restore confidence in the U.S. dollar as a reliable store of value. When people know that their money is backed by a tangible asset, they are more likely to use it and hold onto it. This, in turn, would help to stabilize the economy and promote long-term growth.

Of course, returning to the gold standard would not be without its challenges. For one, there is not currently enough gold in circulation to back up the amount of currency in circulation. This would mean that the price of gold would have to be significantly higher than it is now in order to support the amount of currency in circulation.

Furthermore, returning to the gold standard would likely require significant changes to the U.S. monetary system, including changes to the Federal Reserve’s operations and the way that the government finances its deficits. These changes would require political will and consensus, which may be difficult to achieve in the current political climate.

In conclusion, the switch from the gold standard to fiat currency has had significant consequences for the American people, including increased inflation and a loss of confidence in the U.S. dollar as a reliable store of value. Returning to the gold standard would help to address these problems and promote long-term economic stability. However, doing so would require significant political will and may pose challenges in the short term.

Ultimately, the decision of whether or not to return to the gold standard is one that should be made carefully and with a full understanding of the risks and benefits involved. First and foremost, it would help to restore confidence in the U.S. dollar as a reliable store of value. The gold standard would ensure that every dollar in circulation is backed by a tangible asset, making it more valuable and trustworthy. This, in turn, would help to stabilize the economy and promote long-term growth.

Moreover, returning to the gold standard would provide a natural check on inflation. Under the gold standard, the government would be limited in its ability to print money, since it would only be able to issue new currency if it had a corresponding amount of gold reserves to back it up. This would help to prevent the government from simply printing money to finance its deficits, which is a major cause of inflation.

In addition, the gold standard would help to reign in the government’s spending by putting a limit on how much money it could borrow. Since the government would only be able to issue new currency if it had the corresponding amount of gold reserves, it would be forced to balance its budget and live within its means. This, in turn, would help to promote responsible fiscal policy and reduce the national debt.

Of course, returning to the gold standard would not be without its challenges. It would require significant changes to the U.S. monetary system, and it would likely require significant political will and consensus to achieve. However, the benefits of returning to the gold standard are significant, and they could help to promote long-term economic stability and growth for the American people.

In summary, returning to the gold standard would be beneficial for the American people by restoring confidence in the U.S. dollar, providing a natural check on inflation, and promoting responsible fiscal policy. While it would pose challenges in the short term, the long-term benefits of returnin