On Sunday the Senate passed H.R. 5376, also known as, the Inflation Reduction Act, with a 51-50 vote. Kamala Harris was the 51st vote in favor of the bill.

The Inflation Reduction Act, a compromise forged by Senate Majority Leader Chuck Schumer and Senator Joe Manchin, next heads to the House, expected to vote on Friday.

The government loves putting us further and further into debt. After the installed administration sent billions upon billions of dollars to Ukraine while their president poses on Vogue, Senate passed the $700 bill after an all-night and all-day long series of votes on amendments to the legislation, a process that has been dubbed “vote-a-rama.”

“It has been a long-sought winding road, but at a last, we have arrived,” Schumer said on the floor before the final Senate vote. “I know it has been a long day and long night, but we have gotten it done.”

He predicts that this bill will “change America for decades.”

I don’t doubt anything that the current government does will change our country for decades. And not for the better.

“To those of you who have lost faith that Congress can do big things, this bill is for you,” he said.

Thank you, so much, for spending more money we don’t have.

H.R. 5376 is the largest federal investment in fighting “climate change” coming in at $400 billion. They also extended additional Affordable Care Act subsidies and allow Medicare to negotiate prescription drug prices while capping seniors’ out-of-pocket costs for prescription drugs at $2,000 annually.

House Republican Study Committee Chairman Jim Banks pointed out some of the more radical policies that the bill includes that aren’t being talked about much. The top ten of that list include:

- The bill’s giveaway to green energy would increase American reliance on China for rare earth minerals

- The legislation increases taxes just as the country is entering a recession

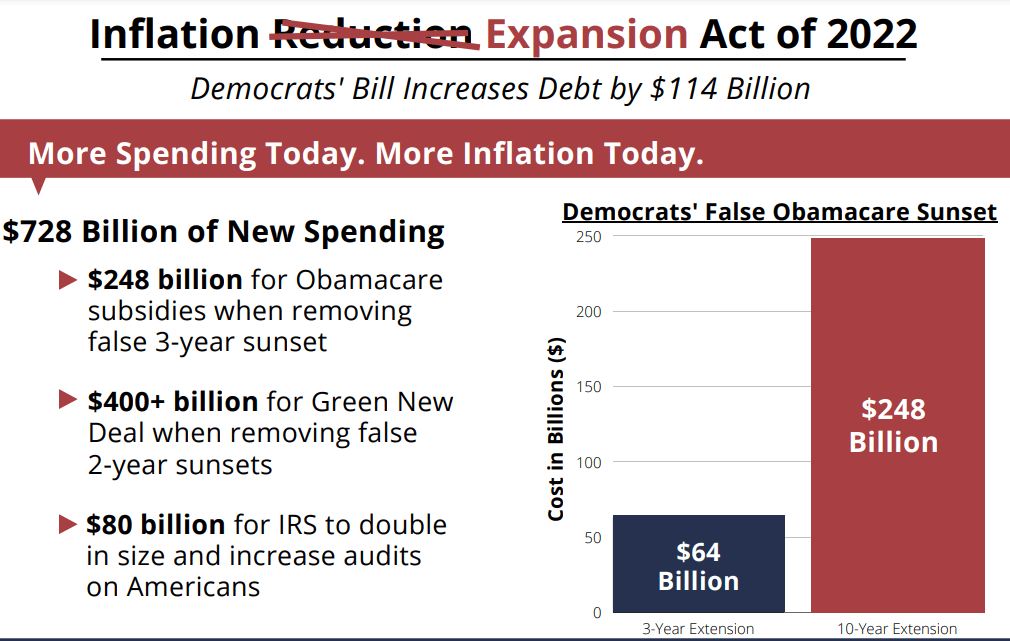

- The bill contains many budget gimmicks and fake offsets to mask the cost of the bill. When accounting for these budget tricks, the alleged deficit reduction bill would add $114 billion in debt over ten years

- The legislation would add $80 billion in funds to supersize the IRS’s ability to audit Americans. This would especially harm middle-class Americans.

- The Inflation Reduction Act contains a “socialist price control regime” to aim to lower drug prices

- Expand Obamacare by extending enhanced Obamacare subsidies

- Create an “environmental justice solar and wind capacity limitation program” to further the Democrats’ “radical ‘environmental justice’ agenda”

- $8.45 billion to further “environmental justice in agriculture”

- $3 billion for the Department of Transportation to undertake projects to address racism in infrastructure

- $5 billion to support $250 billion in Department of Energy loan guarantees and loan refinancing for green energy infrastructure and remediation activities.

This bill is likely to not actually reduce inflation as the Democrats claim. According to the Penn Wharton Budget Model and the Congressional Budget Office (CBO).

Manufacturers will be hit the hardest. They are facing a 15% corporate minimum tax according to the Joint Committee on Taxation. The JCT found that setting a 15 percent corporate minimum tax, which would reportedly raise $313 billion, would especially soak America’s ailing manufacturing sector.

Who do they think will pay for that? The companies? No. It’s we the people.

Basic economics.

When a corporation is taxed or they are paying a higher rate for a product, that cost is passed down to the consumer in the form of higher prices. We will be the ones who suffer because of this.

Representative Jason Smith, the ranking member of the House Budget Committee, stated that the IRA is simply going to add more fuel to the inflation fire. He explained that the Inflation Reduction Act utilizes budget gimmicks and fake offsets to mask the true cost of the bill. Smith said the bill would add $114 billion to the debt when accounting for Manchin’s fake gimmicks.

Smith also noted that many of the tax increases and offsets for the bill amount to “gimmicks:”

- Less than two percent of the prescription drug price control “savings” arrive before 2025

- The bill says it would create $122 billion in “fake savings” by again delaying the Trump-era Rebate Rule that never went into effect

- The Congressional Budget Office (CBO) said it would not score potential savings that arise from increased audits from the IRS

- The bill’s 15 percent corporate minimum tax amounts to a “tried and failed 1980s tax policy” that was repealed by Democrats

Democrats fell short in an effort to include in the legislation a $35 cap on the cost of insulin. Seven Republicans joined with all Democrats on the cap, but that was three short of the 60 needed. Still, a limit on insulin costs for Medicare patients remained in the final version.

Content and media companies also have had varying effective tax rates, which factor in deductions and state and local taxes. Netflix’s effective rate was 12.39% in 2021, while Comcast’s was 27.54%, according to CSI Market data.

Once the legislation passes, it will head to the House, where a vote is scheduled for next Friday.