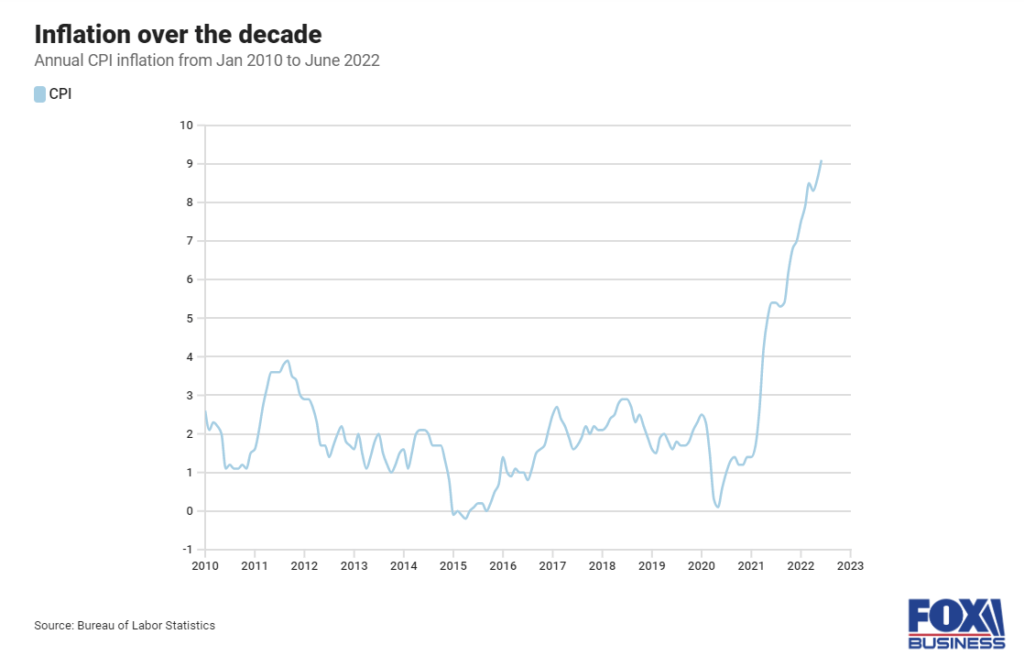

Inflation has been a constant issue plaguing the country, severely affecting all of us. The Labor Department released the consumer price index on Wednesday showing a 9.1% increase from last year.

This increase is the fastest since November 1981 and it is more than what economists expected. The increases were broad-based: Rent, new and used vehicles, car insurance, and medical care all rose in June, the report said.

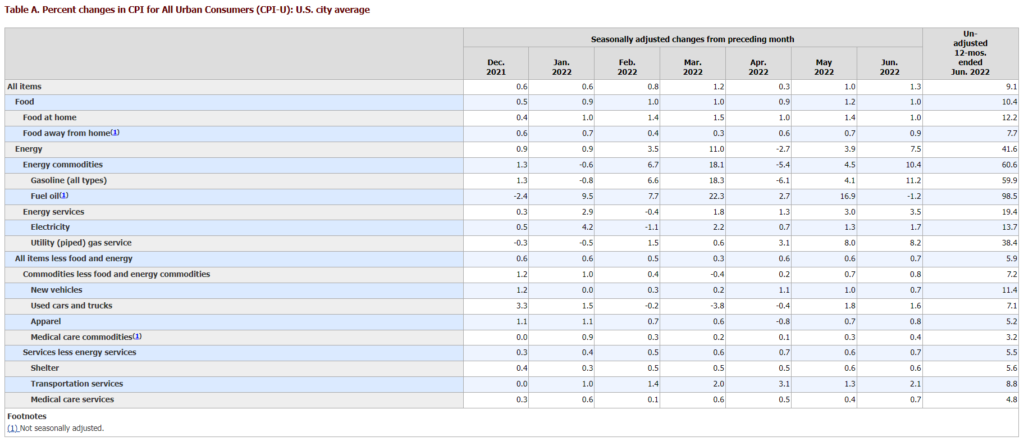

Energy prices are 41.6% from last year. Gasoline, on average, costs 59.9% more than it did one year ago and 11.2% more than it did in May. The food index, meanwhile, climbed 1% in June, as consumers paid more for items like cereal, chicken, milk, and fresh vegetables.

“CPI delivered another shock, and as painful as June’s higher number is, equally as bad is the broadening sources of inflation,” said Robert Frick, corporate economist with Navy Federal Credit Union. “Though CPI’s spike is led by energy and food prices, which are largely global problems, prices continue to mount for domestic goods and services, from shelter to autos to apparel.”

On a monthly basis, headline CPI rose 1.3% and core CPI was up 0.7%, compared to respective estimates of 1.1% and 0.5%.

Rent jumped nearly 1% in June, this was the largest monthly increase since April 1986. Homeowners are also paying .7% more in June than in May.

These increases will significantly affect spending across the board. Of course, it doesn’t help that the real average hourly earnings decreased 1% from the previous month. On an annual basis, real earnings actually dropped 3.6% in June.

Energy prices surged 7.5% on the month and were up 41.6% on a 12-month basis. This was the sixth straight month that food at home rose at least 1%.

Medical costs have always been an issue in the country with our incredibly broken medical system, but that climbed 0.7%, propelled by a 1.9% increase in dental services, the largest monthly rise ever recorded for that sector in data that goes back to 1995.

“Unless the wheels really come off of the economy over the next two weeks, the July decision will very likely be a three quarters of a percent hike—and if not that, a full percentage point increase is more likely than a half percentage point one,” Comerica Bank chief economist Bill Adams told The Post.

White House officials have blamed the uptick in prices on Russia’s invasion of Ukraine, though inflation was already moving aggressively higher before that attack in February. President Joe Biden has called on gas station owners to lower prices.

The administration and leading Democrats also have blamed what they call greedy corporations for using the pandemic as an excuse to raise prices. After-tax corporate profits, however, have increased just 1.3% in aggregate since the second quarter of 2021, when inflation took hold.

If the data continues the way that it has been over the past year, there is speculation that the Fed will have to increase its benchmark interest rate again.

“Across the economy, consumers, business leaders, investors and regulators are all asking the same question: When will inflation peak?” Bankrate senior economic analyst Mark Hamrick said. “Central bankers were caught flatfooted and are now trying to play catch-up and recover some of their bruised credibility.”

Dow futures sank more than 400 points following the June CPI report’s release. Nasdaq futures fell more than 250 points.

The latest data damages the Fed’s credibility even further and raises questions about the effectiveness of its current approach to the problem, according to Nancy Davis, founder of Quadratic Capital Management.

“The Fed is still behind and continues to view inflation only in terms of supply vs. demand. They continue to try to solve inflation from the demand side,” Davis said. “It’s unclear how the central bank gets the inflation genie back in the bottle without a lot of pain along the way.”