UPDATE: Lowered the Patriotism/Wokeness Score to 2 due to the new push for the ESG score within the app.

Since being fiscally Conservative, fiscally responsible and even patriotic should also include how to properly use, save and invest your President-faced money, we’ll start reviewing apps and services that help you do this.

This review is about Acorns. Never heard of it? Know of it, but haven’t used it for a few years? Continue reading because a lot has changed since its inception. Let’s first uncover the foundation of what Acorns is.

What is Acorns?

On the most basic level, Acorns is an app and service that allows you to invest change into the stock market. At its beginning, Acorns was all about getting you to “round up” your spending and that extra change would buy partial shares. This is actually what made it so popular at the start. Purchasing partial shares was something of a novel idea. It used to be possible to ONLY buy full shares. Which can be pretty expensive.

With Acorns, you are able to own stock with as little as a penny. It’s partial stock, but it’s still stock. Basically, Acorns splits the stock up among everyone purchasing that stock. Kind of like a stock crowdfund if you had to compare it to something.

Rounding up your spending, and investing your change into your portfolio is Acorns in a nutshell. However, they have expanded on this idea and there are now different tiers and ways to save and invest your money for things like retirement, kids etc.

Acorns Subscription Tiers

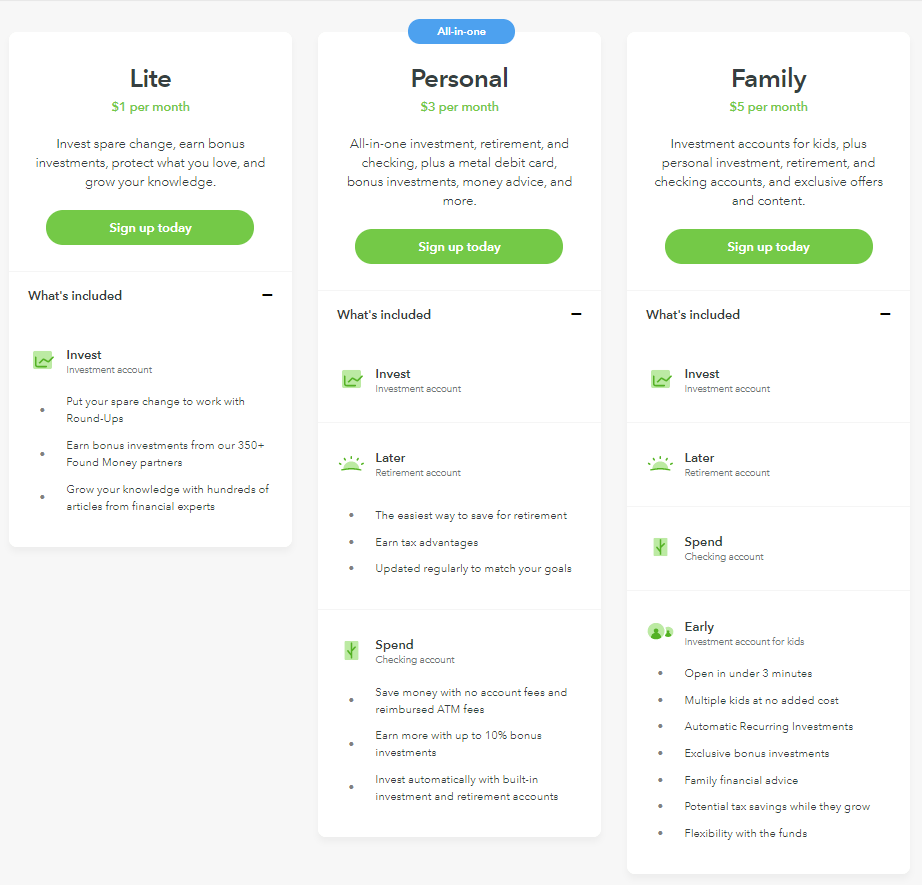

There are now 3 tiers for you to choose from. Acorns recently added the ‘Family’ tier. The pricing you see is what you pay. There are no hidden fees. Obviously, you do need to worry about taxes when withdrawing money; more so with retirement accounts.

The Lite Subscription

As you can see in the image, ‘Lite’ costs $1 per month. This is the bare-bones investing subscription where you round up your spending on whatever linked card(s) you add to your account. You’ll also have access to information on investing so you can learn a thing or two.

Another thing many people don’t know about is that you also get access to the Acorns ‘Found Money’ area. Here, you can actually earn free money by making purchases or signing up for services through Acorns. Companies will actually invest a certain percent of your purchase or outright give a lump sum directly into your investing account. Another secret? Look for the ‘Protect what you love’ section. There are insurance companies willing to give you ‘Found Money’ (typically around $5) into your account, too.

Personal Subscription

The ‘Personal’ subscription adds a retirement account (called Later) and a spending account for $3 per month. So, for an extra $2 per month, you now have access to a retirement account of your choice where again you pick a portfolio based on risk and also a spending account where a a tungsten debit card is included.

You may ask how the ‘Later’ IRA is different from the regular ‘Round-ups’ investing account. The money in the ‘Round-ups’ account is more for short-term investing. There’s less of a tax on taking money out of that account as it isn’t considered a retirement account. It’s also the only account getting the change from your purchases after being rounded up.

The Spending account’s debit card allows you to automatically deposit ‘Round-ups’ when using the card, so there’s no need to worry about which card you linked to the account. It just happens on the fly when using the ‘Spend’ account card. You also have no fees when using the card and any ATM fees are refunded. Last but not least, using the card at certain stores and restaurants can get you an extra 10% invested into your account. After signing up, you’ll get access to a map of wherever you are of places that give this extra investment.

Family Subscription

The ‘Family’ subscription includes the ‘Early’ investing account for another $2 more. So, at $5 you get not only ‘Round-ups,’ Later’ and ‘Spend’ accounts, but also an ‘Early’ account for EACH of your children. That’s right. There’s no extra cost for more than one child ‘Early’ account.

The only negative I see with the ‘Family’ subscription is that since Acorns is based around single users, there isn’t an option to have a Spouse account of any kind. Your spouse will need to create their own Acorns username and account on their own. It’s not a huge deal and I understand the tax implications of having two adult accounts connected, but an option would be nice.

My Take and Is Acorns For You?

Acorns is just one option in this growing investing segment of apps available to you. There are others like Stash and Robinhood. Theose are a bit different and allow you to have full control over which individual stocks you buy, but I’ll write up a separate review for those.

Acorns, however, is a lot easier to get into since you have a lot less to worry about. Acorns will walk you through your options at sign up and what kind of risks you are willing to take. They’ll then set your portfolio up based on your input, but you have full control over how much risk you want to take at all times.

For me, Acorns is a great way to keep a short term investing account always there for some kind of big purchase I see coming in the near future. I think of it as a savings account that collects a lot more “interest” than a savings account does. Especially under the last 4 years under President Trump.

Many might not like the IRA as it isn’t tied to an employer, so you aren’t getting any kind of employer match deposit. That being said, I find having a separate, smaller account like this good in case you were to lose your job and then you would lose that employer match anyway. The name of the game should be ‘having as many baskets as you can, just in case. You know. Diversify your money not only in stocks, but also in many accounts. Also, Acorns can help you transfer your current IRA if you want to completely move all of your money over.

Finally, the ‘Family’ subscription is probably the most valuable to those with more than one child, like myself. The $5 monthly cost is nothing when you have two child accounts. Just those accounts alone would cost at least a couple dollars more elsewhere, and this includes the other 3 accounts and a tungsten debit card.

To me, Acorns is a no-brainer. For you? You just need to decide if you want to buy and sell individual stocks or just like having a portfolio based on risk. Want the portfolio option? Check out Acorns ‘Lite’ subscription. Even if you aren’t sure about the other subscriptions, you can be like me and slowly try it out. Hell, you can always get into another app that allows you to invest in individual stocks, too.

If you would like to start investing with Acorns, you can get $5 for when you use my invite link and sign up for the ‘Personal’ tier. Also, until July 31st 2020, get $10 if you sign up for the ‘Family’ tier. If for some reason the link doesn’t auto-fill the invite code, the code is, GM4DFS.

A Focused Review of Acorns in 2020 – Offensively Patriotic

A Focused Review of Acorns in 2020 - Since being fiscally Conservative, fiscally responsible and even patriotic should also include how to properly use, save...

Product Brand: Acorns

Product In-Stock: InStock

4.5