Table of Contents

America’s Debt and Inflation Dilemma: Sailing into a Financial Storm

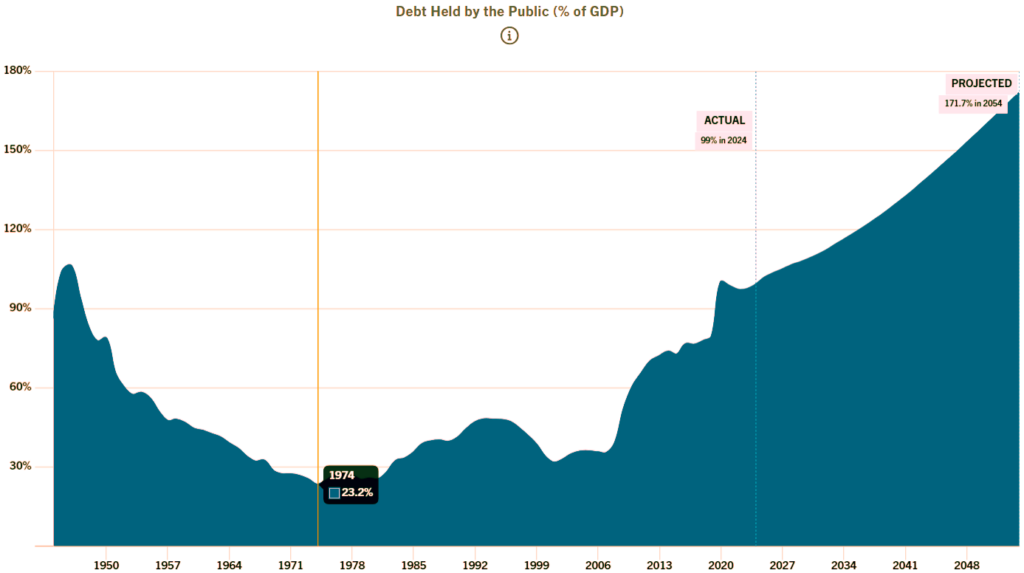

The U.S. is navigating through perilous fiscal waters, with the government’s interest payments on an ever-expanding debt threatening to capsize the nation’s economic stability. With a national debt staggering at $34.6 trillion ($157.8 trillion when including promises, assets and liabilities), the U.S. finds itself in the throes of a financial frenzy, exacerbated by rising interest rates and the resurgence of inflation. This trio of fiscal challenges—ballooning debt, escalating interest rates, and surging inflation—has set the stage for an economic tempest that could wreak havoc on national finances.

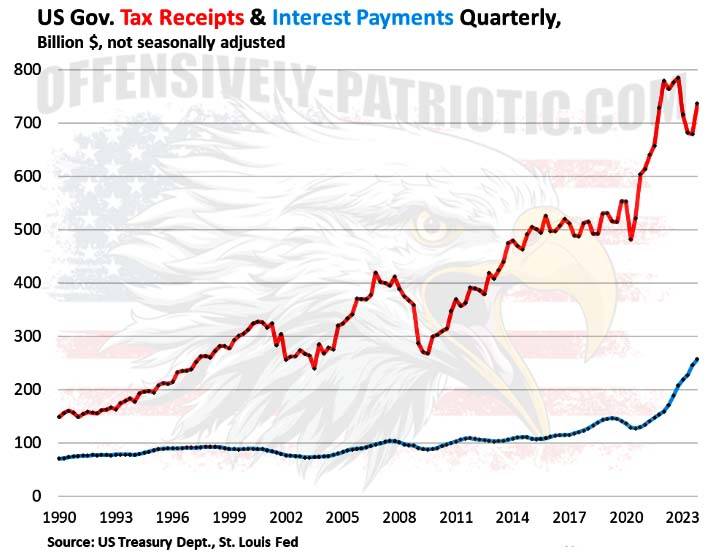

In the final quarter of 2023, interest payments on this colossal debt soared to $256 billion, reflecting an alarming uptick from previous quarters. However, a silver lining appears as tax receipts surged to $736 billion, offering a temporary buoy in the turbulent financial seas.

A Historical Perspective on Fiscal Irresponsibility

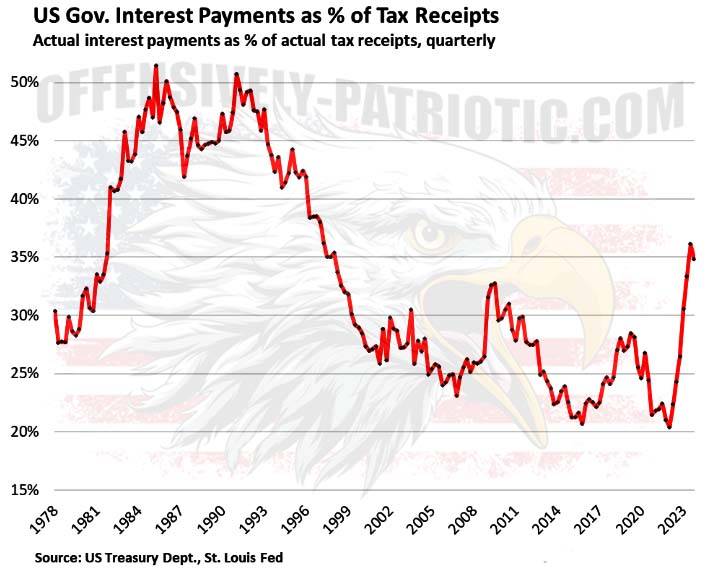

Reflecting on the past, the ratio of interest payments to tax receipts once hovered around 20.4% in early 2022, the lowest since the late ’60s. Yet, this seemingly favorable metric masks the underlying trend of fiscal irresponsibility that has plagued the nation for decades. Between the early ’80s and mid-’90s, this ratio consistently exceeded current levels, peaking during times when congressional action was spurred by fiscal urgency.

Remarkably, from the mid-’90s to the mid-2010s, interest payments remained relatively flat despite the ballooning national debt, thanks to continuously falling interest rates. This period of artificially low interest rates has led to a dangerous complacency in debt management.

The Tax Receipts Mirage and the Interest Payment Surge

Tax receipts, a crucial revenue stream for government operations, experienced a notable increase in the latter part of 2023, buoyed by capital gains taxes from robust stock and crypto markets. This influx of tax revenue, however, is a double-edged sword, potentially masking the underlying fiscal irresponsibility and leading to complacency in addressing the burgeoning debt.

Interest payments, on the other hand, have escalated sharply, driven by the dual forces of rising interest rates and an expanding national debt and inflation. This rise in interest payments signifies a growing burden that threatens to consume a larger share of the government’s financial resources, necessitating a serious reassessment of fiscal priorities.

See Also: Unsustainable Future for U.S. Debt, 88% of Simulations Show

Inflation’s Double-Edged Sword: A Temporary Reprieve or a Long-Term Threat?

Inflation, while temporarily boosting tax receipts and eroding the real value of debt, poses a long-term threat to economic stability. The immediate benefits of inflation in reducing the debt burden are overshadowed by the insidious effects of rising interest rates, which escalate the cost of servicing the national debt.

As the government continues to issue new debt to finance its deficits, the allure of higher yields attracts buyers, ensuring the sale of Treasury securities. However, this mechanism of market demand and supply leads to higher interest costs, further straining the government’s financial capacity.

Conclusion: Navigating the Fiscal Tempest with Prudence and Accountability

The narrative of the U.S. fiscal landscape is a cautionary tale of short-sighted financial policies and a disregard for long-term economic health. The allure of easy money, fostered by years of low interest rates and quantitative easing, has led to a perilous situation where the national debt and inflation have ballooned to unsustainable levels.

As the nation stands at the crossroads of fiscal accountability and economic recklessness, the path forward demands a steadfast commitment to prudent financial management and a reevaluation of fiscal priorities. The journey through these treacherous financial waters requires more than just temporary fixes; it calls for a fundamental shift towards responsible stewardship of the nation’s fiscal future.

How are the debt and inflation levels affecting you and yours? Let us know in the comments below.