In-Depth Analysis Reveals Overwhelming Evidence of a Fiscal Time Bomb and Unsustainable Future

Table of Contents

Introduction

We keep warning about this over and over again, but now it seems like someone is finally running the numbers through simulations. Almost a million of those simulations now warn what we’ve been warning about the unsustainable future our debt is leading us toward. Let’s delve into the looming specter of U.S. debt, a topic sparking renewed urgency amid economic turbulence and geopolitical shifts.

U.S. Debt: A Ticking Time Bomb?

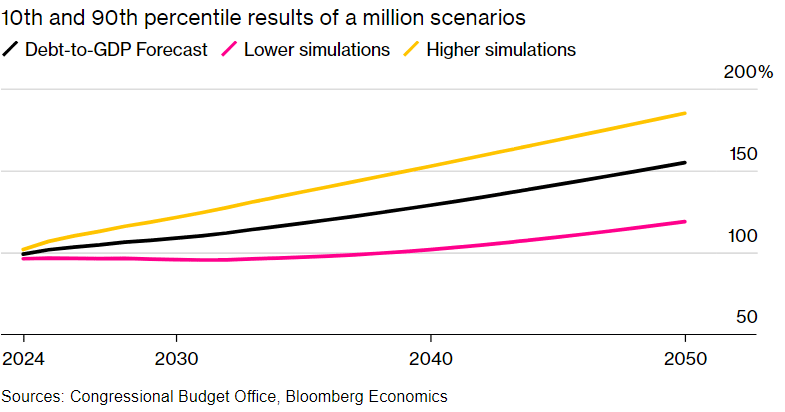

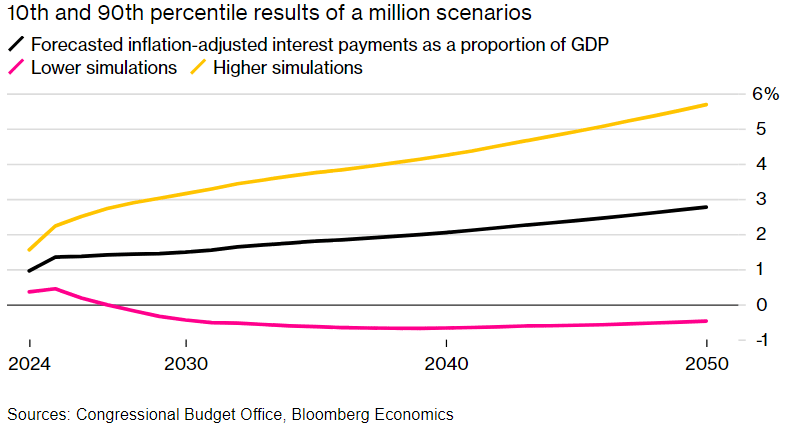

Long-standing warnings about the unsustainable future of U.S. debt seem to have been perennially dismissed. Critics often argued that low interest rates and potential economic growth could mitigate these concerns. However, a comprehensive simulation involving over a million economic scenarios by Bloomberg Economics suggests otherwise. An alarming 88% of these simulations forecast a debt-to-GDP ratio trajectory that veers into the red zone of unsustainability.

The Alarming Debt-to-GDP Ratio

The current discourse gains gravity when we consider that the debt-to-GDP ratio, standing at a staggering 97% last year, has nearly doubled since 2009. With the Congressional Budget Office (CBO) projecting this ratio to hit a record 116% by 2034, the alarms are sounding louder than ever.

Voices of Concern

From Wall Street to Washington, the anxiety over U.S. debt is palpable. Titans of finance like BlackRock’s Larry Fink and Citadel’s Ken Griffin have openly expressed their apprehensions, emphasizing the urgency of the matter. Even Federal Reserve Chair Jerome Powell has stepped into the fray, signaling it’s high time for a fiscal reckoning.

When Blackrock is sounding alarms, you know it’s bad; or at least it’s bad for them.

See Also: US Debt Skyrockets, Adds Half Trillion Dollars in 2 Weeks, Threatening American Prosperity

The Administration’s Stance and Economic Simulations

Amid these dire warnings, Treasury Secretary Janet Yellen defends the Biden administration’s fiscal strategy, arguing for the sustainability of their approach. Yet, even optimistic simulations concede that looming defense expenditure and persistent high-interest rates spell a challenging fiscal future.

Notably, Harvard’s Kenneth Rogoff, a former IMF chief economist, critiques Washington’s lax debt attitude, foreseeing regrettable repercussions.

“Washington in general has a very relaxed attitude towards debt that I think they’re going to be sorry about.”

Kenneth Rogoff, Former IMF Chief Economist

Conclusion

Our nation stands at a fiscal crossroads, with mounting debt threatening the very fabric of our economic stability. It’s a clarion call for policymakers to craft a prudent path forward, balancing growth with fiscal responsibility. For the patriotic citizen, vigilance and informed discourse are our best tools in holding our leaders accountable for the economic legacy they’ll leave behind.

Further, this proves that the best course of action forward is to shrink the government. Shrink it until it almost gone.

What are your thoughts? We’d love to have your thoughts in the comments below.