Many Seem to Believe That the US Has Never Defaulted, But That Couldn’t Be Further From the Truth

Introduction

The belief that the United States has never defaulted on its debt is a widely held misconception. While it is true that the US has maintained a strong reputation for meeting its debt obligations, there have been instances in the nation’s history where it has indeed defaulted. Despite popular belief, the US government has experienced four notable episodes of default throughout its existence, challenging the notion of an unblemished record. In this article, we will delve into these occurrences and shed light on the historical truth behind America’s debt defaults.

The Revolutionary War and the Continental Congress

During the Revolutionary War in the late 18th century, the Continental Congress issued significant amounts of debt to finance the war effort against British forces. However, the fledgling United States struggled to repay its creditors, resulting in multiple defaults. The severity of the defaults varied, but they underscored the reality that the US had, in fact, failed to meet its debt obligations early in its history.

The War of 1812

Another instance of default occurred during the War of 1812. The US government once again faced financial strain due to the conflict with Britain. As a result, it was unable to honor its debt commitments, leading to a default. The lack of resources and the economic disruption caused by the war contributed to the failure to meet financial obligations.

The Civil War

The Civil War era brought about the third notable default in US history. As the nation was embroiled in a devastating internal conflict, the federal government faced immense challenges in meeting its financial obligations. In 1862, the US Treasury temporarily suspended interest payments on government bonds, effectively defaulting on its debt. It wasn’t until several years later that the government resumed payments, albeit at a reduced rate, highlighting the economic strain caused by the war.

The Great Depression

The Great Depression of the 1930s had a profound impact on the US economy and led to the fourth default in the nation’s history. President Franklin D. Roosevelt, facing an economic crisis of unprecedented magnitude, made the decision to abandon the gold standard. This effectively devalued the dollar and resulted in a technical default on the country’s debt held by foreign governments, as they were now being repaid in a currency that had depreciated significantly.

Conclusion

Contrary to popular belief, the United States has, in fact, defaulted on its debt multiple times throughout history. The Revolutionary War, the War of 1812, the Civil War, and the Great Depression all witnessed episodes of default. While these defaults may have varied in severity and circumstances, they serve as a reminder that even a nation as economically powerful as the United States is not immune to financial challenges. Recognizing and understanding these instances of default is crucial for a comprehensive understanding of the nation’s economic history and its ongoing debt management strategies.

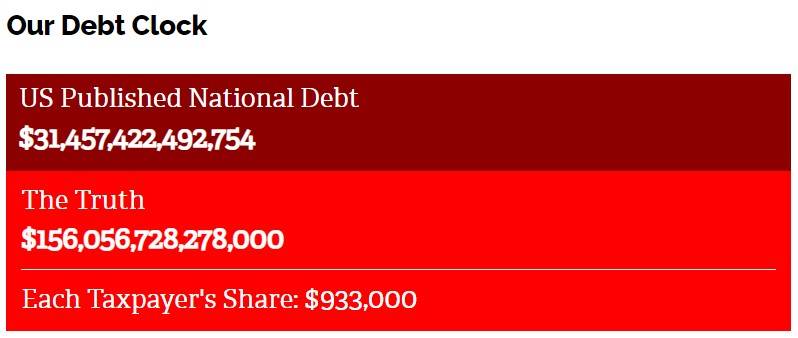

On top of this, it’s important to understand that a default isn’t the end of the world, or in this case, the end of this nation. It’s also important to know that “raising the debt ceiling to pay our bills” isn’t paying our bills. It’s like getting another credit card to pay for your electric bill. It’s not paying your electric bill. Instead, you are simply moving your indebtedness around to new places while increasing your debt.

The point? Raising the debt ceiling to “keep us out of trouble” is only moving the trouble elsewhere, to a later point in time while increasing said trouble and leaving that burden with future generations.